Business Tax Consultant, Graduate (August 2026)

We are looking for graduates with enquiring minds and a sociable disposition to join our August 2026 intake of trainees in our Business Tax team.

About Us

Buzzacott is a passionately independent and growing professional services firm. We are based in the City of London, with a satellite office in Hong Kong.

We are partner led and focused on people – our team and our clients. We combine market leading sector expertise and excellent service capability to provide exceptional service in our chosen markets.

Team Overview

Legislation is always changing, and it is up to the Business Tax Team made up of approximately 40 people to continuously stay on top of it. In this team, you will be putting together tax strategies that perfectly suit the needs of clients, their employees, shareholders – and the tax authorities. You will be looking for exciting new opportunities and supporting clients through any changes that will impact their business.

The nature of your work will flex in line with the situation of your clients, and the services offered will be adapted to suit clients on any scale, including fast-growth entrepreneurial businesses, intergenerational family businesses, professional practices, and international groups of companies. The team has a training ethos with a focus on taking on trainees who want to build a career in tax.

This role is due to commence in August 2026.

The Role

In this role, you will be working with the Business Tax team’s clients under the supervision of more senior team members, ensuring all compliance issues are dealt with efficiently and accurately, and recognising opportunities for tax planning and additional service.

In addition, you will study towards becoming an Associate Chartered Accountant (ACA) as well as a Chartered Tax Advisor (CTA). Studying towards these professional qualifications, as well as learning from our team of specialists on a daily basis, ensures you are well equipped with the knowledge to help advance you through your career.

Training consists of a combination of courses at the tutors’ offices, private study and regular exams, as well as on-the-job training. You will have paid study leave to support you in the run up to exams and all course and exam fees are paid for.

What’s In It For You

We go above and beyond for our clients, but also for you. We have a genuine commitment to your development, offering you a closely supported and structured programme of tuition, provided by a top firm of external tutors. Internally, you’ll be supported by a manager who will act as your mentor, a trainee buddy, partners, senior staff and a dedicated Learning & Development team.

As you progress through your training you will receive incremental salary increases as you hit various milestones in your qualification.

What You’ll Be Doing

- Preparing tax computations and returns for a range of corporate clients and partnerships, under the supervision of a Manager.

- Drafting correspondence on technical tax matters for Manager review.

- Discussing and resolving basic queries directly with clients, via email, Teams calls and in face-to-face meetings.

- Producing clear and technically accurate letters for submission to HM Revenue & Customs.

- Collaborating with colleagues across the firm as part of our full service offering to clients.

- Developing your technical knowledge and learning to identify tax planning opportunities for clients, and supporting Managers with interesting tax advisory projects.

- 2:1 Degree

- 120 UCAS tariff points from 3 A-levels, or equivalent.

- Level 6 (B grade using the old system) in GCSE Maths and English Language, or equivalent.

- MS Office Suite (Word, Excel, PowerPoint, Outlook).

- The right to work in the UK without restrictions for the duration of the training contract

Please note we do not accept General Studies or applications from part-qualified applicants.

What You’ll Bring

- Excellent interpersonal skills in order to interact professionally with internal and external clients.

- Able to prioritise workload and be self-sufficient; multi-tasker; problem-solving skills.

- Displays ethical judgement.

Why Buzzacott?

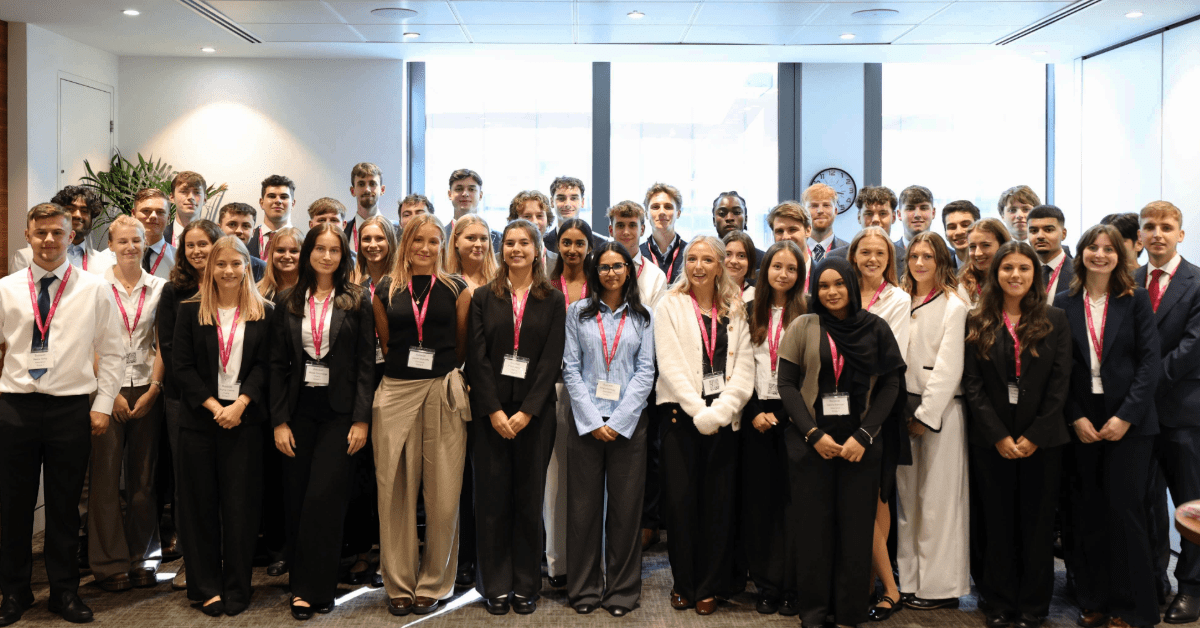

We’re big enough to provide deep expertise across a wide range of specialisms, but small enough to value meaningful personal connections — with clients and colleagues alike. You’ll work alongside experienced professionals who will support your continued development, while you contribute to shaping the growth of both our team and our clients.

At Buzzacott, we’re committed to equal opportunities and ensuring all employment decisions are fair, objective, and based on merit.

To see more information about our Rewards & Benefits follow this link.

To find out more about life at Buzzacott, please click here.

To hear from team members across the firm on their experience of life at Buzzacott, please click here.

- Team

- Business Tax

- Role

- Trainee (Graduate)

- Locations

- London